What Passengers and Drivers Need to Know About Uber & Lyft Policies

If you’re involved in an accident while using a rideshare service like Uber or Lyft, understanding insurance coverage is essential. Rideshare insurance policies can be complex—but knowing what is (and isn’t) covered can help you take the right steps after a crash. At Pyramid Legal, we help rideshare accident victims navigate these insurance layers and protect their rights.

How Rideshare Insurance Works

Rideshare companies like Uber and Lyft use tiered insurance policies that vary based on the driver’s status at the time of the accident. Whether you’re a passenger, another driver, or a pedestrian, your ability to recover damages will depend on which tier applies.

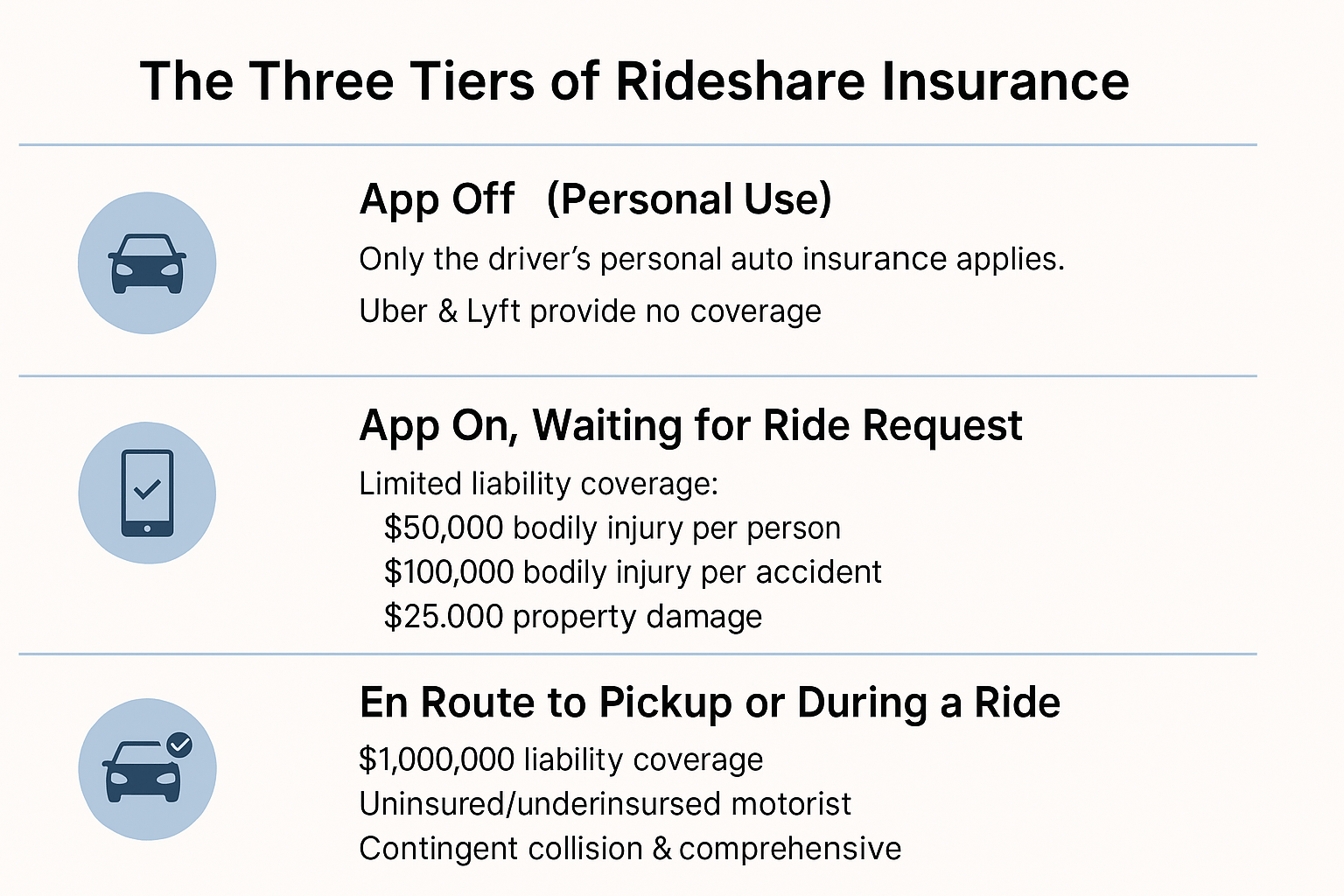

The Three Tiers of Rideshare Insurance

1. App Off (Personal Use)

When the driver’s Uber or Lyft app is off, only their personal auto insurance applies.

Uber and Lyft provide no coverage if the driver is offline and not available for rides.

2. App On, Waiting for Ride Request

If the app is active but no ride has been accepted yet, limited liability coverage is available:

$50,000 for bodily injury per person

$100,000 for total bodily injury per accident

$25,000 for property damage

This coverage is contingent, meaning it only applies if the driver’s personal policy doesn’t cover the damages.

3. En Route to Pickup or During a Ride

Once a driver accepts a ride and is en route to the passenger or actively transporting one, Uber and Lyft provide:

$1,000,000 in third-party liability coverage

Uninsured/Underinsured Motorist Coverage

Contingent Collision and Comprehensive Coverage (with a deductible, typically $2,500 for Uber, if the driver carries such coverage on their personal policy)

Who’s Covered After a Rideshare Accident?

Depending on your role, here’s what coverage might look like:

Passengers: Fully covered during active rides

Drivers: Covered according to app status and personal insurance

Other Motorists or Pedestrians: May be covered by the rideshare company’s policy or driver’s personal policy

It’s important to note that rideshare companies may try to deny responsibility or minimize payouts. That’s where legal guidance matters.

What to Do After a Rideshare Accident

If you’re involved in a crash with a rideshare vehicle:

Call 911 and get medical help if needed

Document names, license plate, and screenshots from the rideshare app

Take photos of the scene

File a police report

Consult a personal injury attorney

Pyramid Legal can help you determine which insurance tier applies and how to pursue full compensation.

How Pyramid Legal Can Help

We Clarify Complex Insurance Claims

Rideshare accidents involve multiple parties, insurance policies, and potential legal gray areas. Our firm provides:

Clear Legal Guidance

We break down complex policies and explain your rights.Claims Investigation

We identify all liable parties and coverage sources.Aggressive Representation

We pursue maximum compensation from drivers, insurers, and rideshare platforms.Personal Support

We walk with you every step of the way.